Join TbfyReviewer’s newsletter to receive every new article.

7 Best CRM for Financial Advisors: Ranked and Reviewed

Hossam jamjama

- June 6, 2023

If you are a financial advisor, you need to stay organized with your client’s information and data.

The best way to do that is by using a customer relationship management (CRM) system for financial advisors. In this article, we will go over the 7 best CRM software for financial advisors that are available in the market.

What Are the Best CRM for Financial Advisors?

A CRM system allows you to manage your clients’ data, schedule meetings, send emails, track leads, and streamline workflows.

After extensive research and analysis, we have compiled a list of the 7 Best CRM software solutions for financial advisors:

Each of these CRM software options offers features that are specifically designed to meet the unique needs of financial advisors, including compliance tracking, data security, integrations with financial planning tools, mobile accessibility, and customization options.

Let’s dive into each one in detail.

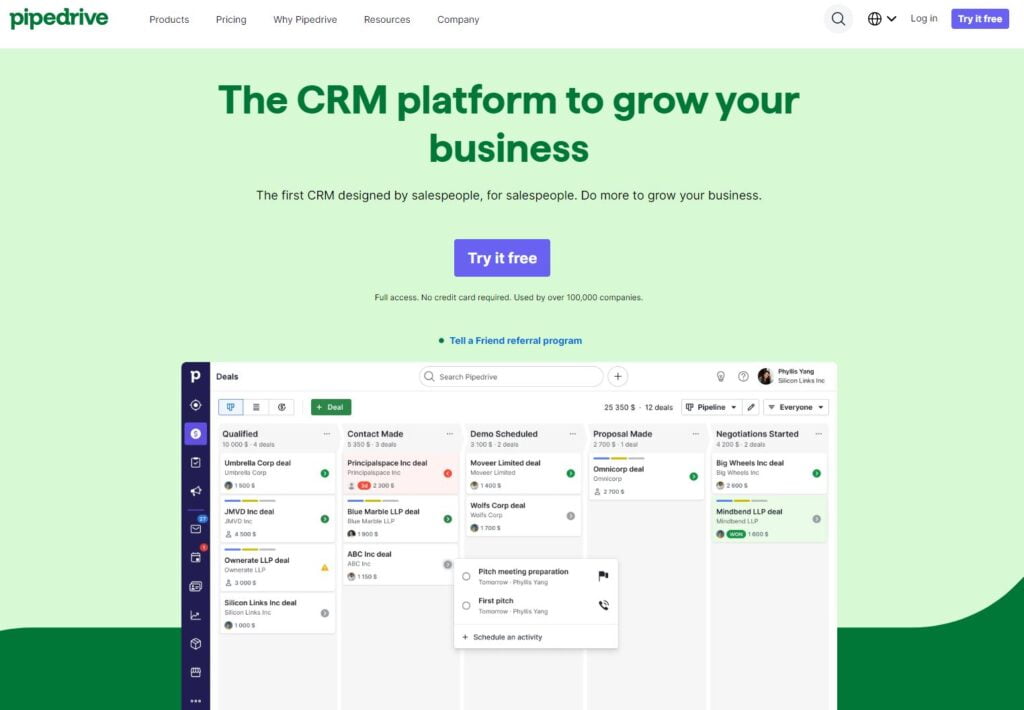

1| Pipedrive Review

Pipedrive is a powerful and customizable customer relationship management (CRM) software designed specifically for sales teams, including financial advisors.

It is packed with features to help you manage your leads, track deals, and automate tasks in a user-friendly interface.

Key features of Pipedrive:

- Pipeline management to visualize stages of a deal

- Activity reminder notifications to stay on top of tasks and calls

- Customizable lead data fields for personalized information

- Email integration for seamless communication with clients

- Reporting and forecasting tools to analyze sales performance

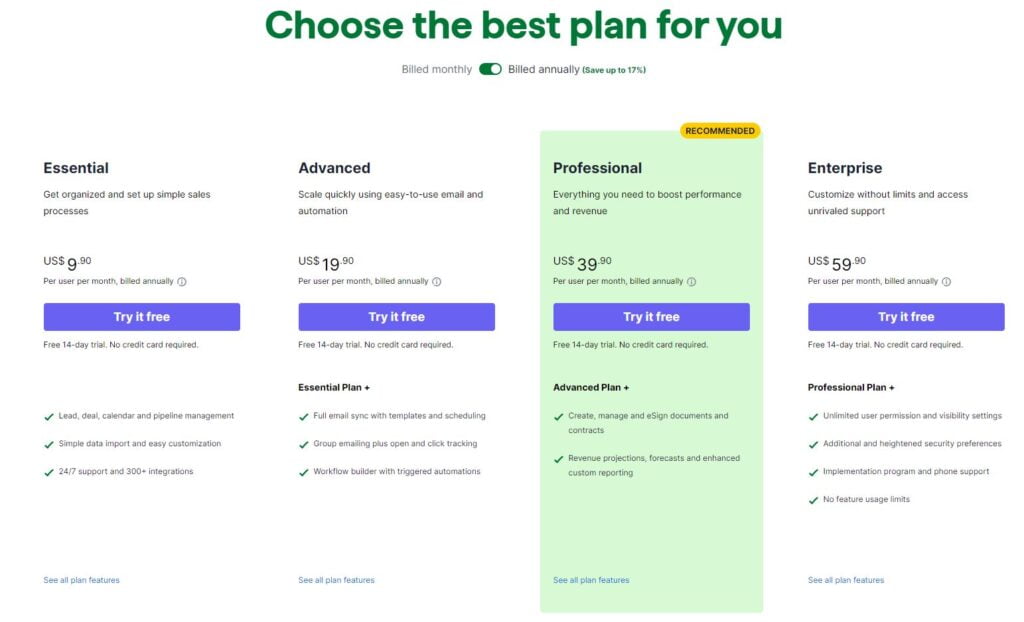

Pipedrive Pricing:

Pipedrive offers five pricing plans:

- Essential cost is $9.90/user/month.

- Advanced cost is $19.90/user/month.

- Professional costs $39.90/user/month.

- Power plan cost $49.90/user/month.

- Enterprise cost $59.90/user/month.

They offer a free trial to users who want to explore their platform before subscribing.

✔ Pros of Pipedrive:

- Easy-to-navigate interface

- Customizable for your team’s workflow

- Great integration options

- Helpful CRM reporting features

- Excellent customer support

❌ Cons of Pipedrive:

- Limited reporting in lower-priced plans.

- Some features may require customization by IT.

- Not enough automation options.

Pipedrive Is Ideal For Whom?

Pipedrive is best for financial advisors who need a complete CRM platform that allows them to customize their workflows, track leads, automate mundane tasks, and get meaningful insights from data analytics. It’s also ideal for those who are comfortable with setting it up themselves and working with limited automation options.

Pipedrive is one of the best CRMs for startups.

2| Less Annoying CRM review

Less Annoying CRM is a cloud-based CRM solution designed for small businesses, freelancers, and solo entrepreneurs, including financial advisors.

The platform provides an extensive range of functionalities that can help in streamlining business operations but with fewer complexities and greater accessibility.

Key Features of Less Annoying CRM:

- Simple interface for easy usage.

- Contact management to organize all client information in one place.

- Task management for setting reminders and tracking progress.

- Sales pipelines for visualizing deal stages.

- Accessible reports for insights into business performance.

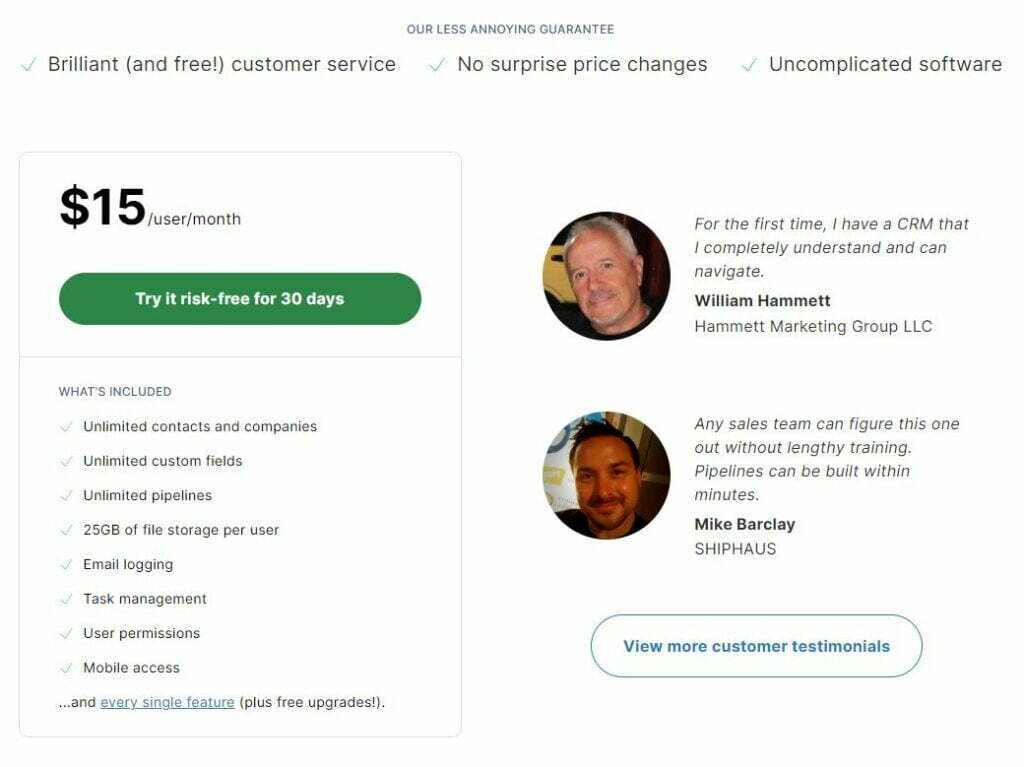

Less Annoying CRM Pricing:

Less Annoying CRM offers a single pricing plan of $15/user/month, with no hidden fees or additional costs.

Users can also avail of a free trial before committing to their subscription.

✔ Pros of Less Annoying CRM:

- User-friendly interface and easy navigation.

- Provides all basic features expected from a CRM.

- Quick response times from the support team.

- Offers personalized onboarding and training.

❌ Cons of Less Annoying CRM:

- Limited customization options

- Lack of advanced automation features

- No mobile app

Who Are Less Annoying CRM Suitable For?

Less Annoying CRM is an excellent choice for financial advisors who are managing a small practice or operating solo. It’s easy to navigate and comes with essential features at an affordable cost.

Additionally, if you need any training or assistance, their customer support team is always ready to help.

3| Zoho CRM review

Zoho CRM is a cloud-based customer relationship management software designed to help businesses of all sizes streamline their sales, marketing, and customer service processes

It offers a user-friendly interface, automation tools, and advanced analytics features that allow users to manage their entire sales pipeline from prospecting to deal closure.

key features of Zoho CRM:

- Easy to use interface with customizable dashboards

- Lead and contact management, email marketing, and social media integration.

- Advanced analytics with reporting and forecasting features.

- Automating sales processes with workflow automation.

- Integrations with popular third-party apps including G Suite, Mailchimp, and Microsoft Office.

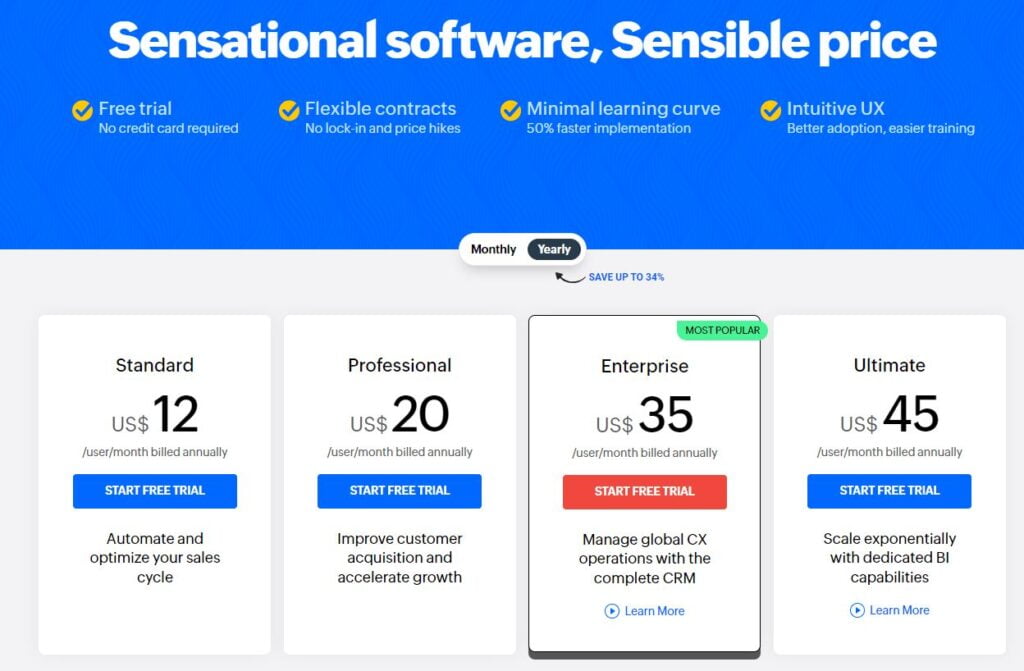

Zoho CRM Pricing:

Zoho CRM provides four pricing plans:

- Standard for $12/user/month.

- Professional for $20/user/month.

- Enterprise for $35/user/month.

- Ultimate for $45/user/month.

You can try each plan for free. They also offer a free version with limited functionalities.

✔ Pros of Zoho CRM:

- User friendly interface that is easy to navigate

- Customizable dashboards allow for personalized workflows

- Advanced analytics provide key insights for decision-making

- Automation tools help streamline sales processes

- Integration with third-party apps enhances the overall functionality

- Excellent customer support

❌ Cons of Zoho CRM:

- Some users may find the number of features overwhelming

- Limited mobile app capabilities

- Data migration can be time-consuming

Who is Zoho CRM best for?

Zoho CRM is best suited for small to medium-sized businesses looking for an all in one CRM solution with advanced features that can help automate sales processes.

It is especially useful for those who are just starting or growing their business. Businesses that require complex integrations may also benefit from using this software.

You can try it out for free and then upgrade if you need more advanced capabilities.

4| Wealthbox review

Wealthbox is a web-based CRM that was specifically designed for financial advisors.

It provides a flexible and user-friendly platform to manage client data, enhance customer relationships and streamline workflows.

Key Features of Wealthbox:

- Intuitive interface tailored specifically for financial advisors.

- Customizable workflows to fit individual business needs.

- Intuitive collaboration tools to engage clients more effectively.

- Mobile app available for on-the-go access.

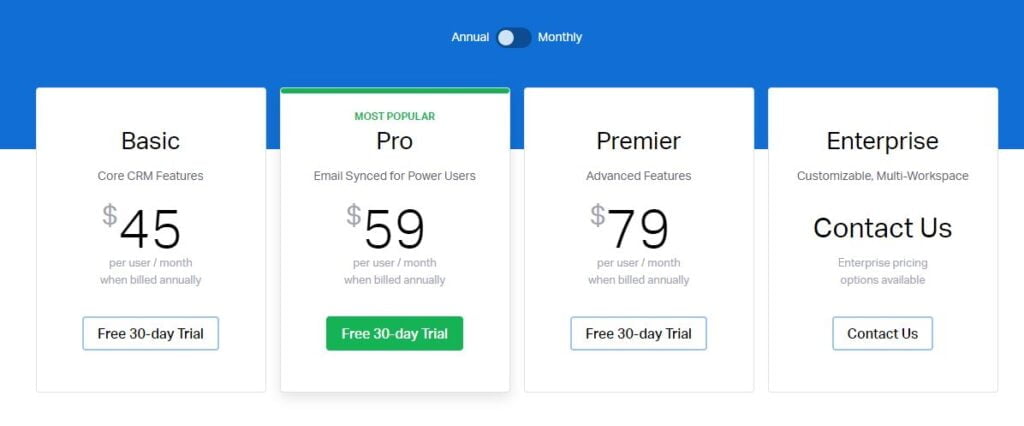

Wealthbox Pricing:

Wealthbox offers a free 30-day trial followed by paid plans starting at $45/user/month for the Basic plan.

- The Pro plan cost $59/user/month.

- The Premier plan cost $79/user/month.

- Enterprise plan (Customizable price)

There are no setup fees or contracts required, and pricing is determined by the number of users.

✔ Pros of Wealthbox:

- Simple, clean design with an intuitive interface.

- Customizable workflow options.

- Excellent customer support.

- Collaboration tools help enhance client engagement.

- Mobile app provides flexibility and convenience on-the-go.

❌ Cons of Wealthbox:

- Limited integration capabilities with other third-party software.

- Reporting features may be limited for some users.

- Some users may find it lacking in certain features compared to other CRMs.

Who Are Wealthbox Suitable For?

Wealthbox is best suited for financial advisors who require specific features tailored to their profession, such as contact management, opportunity tracking, integration with custodial account providers, and advanced reporting tools.

It’s ideal for those who need a simple, clean CRM that’s easy to use without requiring too many bells and whistles.

The CRM may not be suitable for larger firms that require extensive customization and integrations.

5| UGRU CRM review

UGRU CRM is a powerful lead management, client relationship, and marketing automation system for financial advisors. It allows users to track their client’s information and interactions to better understand their needs.

Additionally, it streamlines communication with clients, allowing for personalized messaging and email campaigns.

Key features of UGRU CRM:

- Automated lead capture and tracking system.

- Management of client accounts and portfolios.

- Customizable reporting and analytics tools.

- Integration with third-party applications like Mailchimp, Google Calendar, and more.

- Multi-channel messaging capabilities.

UGRU CRM Pricing

UGRU CRM offers a tiered pricing structure based on the number of users required. Prices range from $59 per month for 3 users up to $324 per month for 3 users.

The Plans are as follows:

- CRM PLUS for $59/mo, includes 3 users.

- PERFORMANCE for $139/mo, includes 3 users.

- PROFESSIONAL for $179/mo, includes 3 users.

- ADVISOR PRO cost $324/mo, and includes 3 users.

✔ Pros of UGRU CRM:

- Customizable dashboards allow users to quickly access relevant data.

- Integration with third-party apps expands the functionality.

- A simple interface makes it easy for novice users.

- The affordability of the plans makes them budget-friendly for small businesses.

- In-depth reporting allows for better strategic decision-making.

❌ Cons of UGRU CRM:

- There is no mobile application as of yet.

- The basic plan is limited in terms of features.

- Some more advanced features have a learning curve.

UGRU CRM Is Ideal For Whom?

UGRU CRM is best suited for independent financial advisors wanting to streamline their business processes with industry-specific tools.

It is also ideal for smaller firms looking for a scalable solution that can grow with them as their business expands.

Those who require extensive integration capabilities or advanced reporting features may need to consider other CRM platforms.

6| Redtail Technology review

Redtail Technology is a cloud-based CRM software designed specifically for financial advisors.

The software aims to make it easier for financial professionals to manage their daily tasks, automate workflows, and organize their clients in a well-structured way.

Key features of Redtail Technology:

- Automated workflows and task management.

- A customizable dashboard for quick access to critical information.

- Email and text messaging integration.

- Advanced reporting software with easy exporting options.

- Secure document sharing.

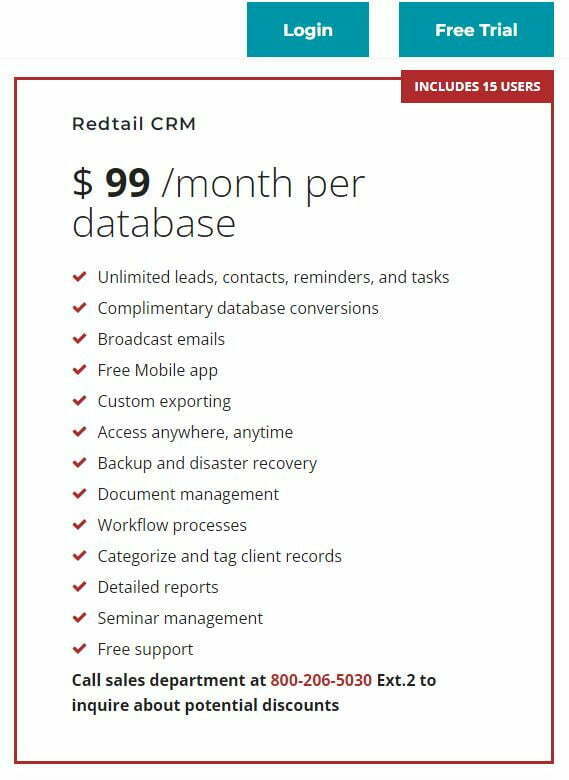

Redtail Technology Pricing

Redtail Technology offers a single pricing plan that costs $99/month per database and includes 15 users. They also offer a free trial to test the platform.

✔ Pros of Redtail Technology:

- The interface is easy to navigate, with intuitive workflows making it straightforward to use.

- The reporting feature presents customization options that allow users to gather precise insights about their business.

- Integration with leading financial planning software like Advyzon.

- Mobile platform makes managing tasks on the go simple.

❌ Cons of Redtail Technology:

- Redtail Technology lacks certain advanced features like an e-signature capability, which could be limiting for some advisors.

- The price may be seen as expensive for small businesses or firms.

Who Are Redtail Technology Suitable For?

Redtail Technology is best suited for medium to large-sized financial advisory firms and independent advisors who require customizable automation, proactive workflows, and robust email marketing tools.

With its mobile app accessible on the go, Redtail caters to people who want to have a comprehensive view of their business anytime they need them.

7| AdvisorEngine review

AdvisorEngine is an all-in-one wealth management software that provides a range of tools aimed at empowering financial advisors.

It helps streamline various processes involved in portfolio management with features such as risk assessment as well as resources for investment management making money work better.

Key features of AdvisorEngine:

- Personalized client portal for secure communication between client and advisor.

- Automated investment management, including portfolio rebalancing.

- Customizable billing and payment options.

- Advanced risk assessment capabilities.

- Integration with popular apps like Salesforce.

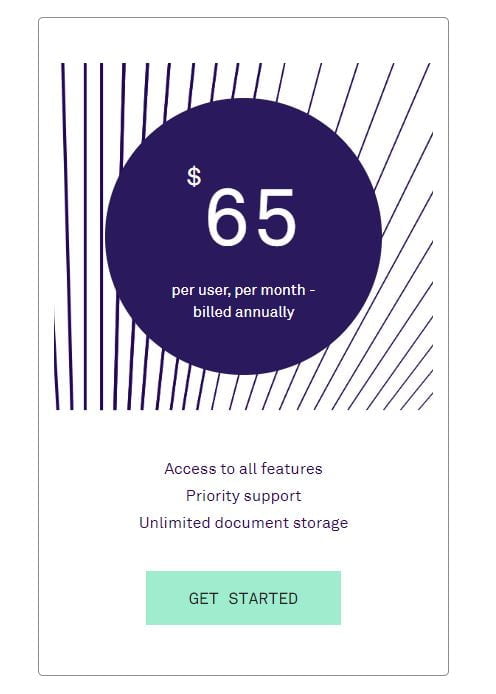

AdvisorEngine Pricing:

AdvisorEngine offers a single pricing plan for $65 per user, per month – billed annually.

✔ Pros of AdvisorEngine:

- The platform provides an intuitive user experience with easy navigation.

- Advisors can streamline all aspects of wealth management under one platform.

- The advanced listening and reactive features make it easier to manage client expectations and deliver better services.

- Offers exceptional support via phone, email, chat, and online helpdesk systems.

❌ Cons of AdvisorEngine:

- Advisors using AdvisorEngine may need additional products to fulfill specific requirements such as financial planning software or compliance tools.

- The cost of customization and integration could get expensive for smaller companies.

Who Are AdvisorEngine Suitable For?

AdvisorEngine is an ideal platform for financial advisory firms that require a complete range of wealth management functions with advanced automation features.

AdvisorEngine is a suitable solution for companies that want custom onboarding experiences, and advisory reports to assist them in the retention of their existing customer base.

Its capabilities are wide-ranging serving both retail and institutional customers providing their advisors with personalized service tools.

What is a CRM System in Financial Services?

A CRM system in financial services provides a centralized platform for managing client information, communication, workflow automation, and business process optimization.

It allows financial advisors to streamline their operations by providing easy access to client data and ensuring that all interactions are tracked.

A good CRM system can help enhance customer relations management by making it easier to address customer concerns quickly or identify emerging trends effectively.

If you are in the real estate industry you may want to read also What is a CRM in Real Estate and What Does CRM Stand For In Real Estate.

Check out also What Role Can A CRM Play In Effective Martech Stack.

Importance of CRM in the Financial Advisory Industry

The financial advisory industry relies heavily on strong customer relationships built on trust and transparency.

A good CRM system plays a crucial role in achieving this goal by providing integrated channels of communication between professionals and clients while keeping track of all important details.

Without an efficient CRM system like the ones we’ve reviewed below, advisors might fail to maintain consistent follow-up procedures with clients leading to missed opportunities, and impacting long-term partnerships negatively.

Criteria for Selecting the Best CRM for Financial Advisors

When selecting a CRM system, there are several factors to consider. Here are some of the most important ones:

A. Integration with Financial Advisory Tools

The best CRM software should have inbuilt integrations with financial advisory tools like financial planning software, as well as marketing automation systems and email communication management.

B. Customization Options for Financial Workflows

A great CRM system should offer customization options for workflow automation based on each advisor’s unique business needs.

This feature allows them to automate common tasks like billing and account updates efficiently.

C. Data Security and Compliance Features

In the Financial Advisory sector, compliance is paramount, so choosing a CRM system that prioritizes data security is essential.

he vendor must be compliant with all regulatory requirements concerning privacy in sensitive data.

D. User-Friendly Interface and Ease of Use

The best CRM software solutions should be intuitive and user-friendly to enhance productivity and ease of use, regardless of the level of technical expertise.

E. Mobile Accessibility and App Availability

Mobile access has become increasingly crucial in today’s fast-paced business environment.

Having mobile access features or mobile applications will help you remain connected on the go anytime, anyplace, which can also boost productivity when working remotely.

FAQs

Why do financial advisors need a CRM?

A CRM can help financial advisors streamline their operations, organize client information, and improve communication with clients. It can also help to increase efficiency and productivity.

Can I use a CRM if I am a solo financial advisor?

Yes, many CRMs are designed with solo practitioners in mind. They typically offer affordable pricing options and basic features to help streamline operations.

How much does a CRM for financial advisors cost?

Costs vary depending on the provider and the features included. Some CRMs offer tiered pricing plans based on user count or feature package. These prices range from $9/user/month to $250/user/month.

Is it worth investing in a CRM for my financial advisory practice?

Yes, investing in a CRM can have significant benefits to your business including:

- Increased efficiency and productivity.

- Improved organization of client data.

- Better communication with clients.

- More targeted marketing efforts.

conclusion

Now that we’ve walked through our top 7 Best CRM For Financial Advisors, remember to choose a system reliable, easy-to-use platform that includes customization options tailored uniquely for your specific business goals.

As technology continues to evolve in this industry space, having cutting-edge software will ensure long-term success in your business while enabling financial advisors to grow closer relationships with their clients through exceptional service delivery.

Check out also our list of Best CRM for Real Estate Investors and Best Real Estate Wholesaling Software for your business.

- Last Update OnJune 6, 2023

- ByHossam jamjama

Hossam Jamjama

Hey, it’s Hossam. I am a full time digital marketer & an online business owner. I write guides and in-depth reviews of the best SaaS products available. To help businesses make informed decisions about picking the right one for them.

Disclosure: TbfyReviewer is a participant in various affiliate programs, which means we may earn a commission when you buy something through links on our site at no cost to you if you decide to purchase a paid plan. You can read our affiliate disclosure.

Table Of Content